Ever since Perla Ruvalcaba graduated from high school, she has worked a part-time job at In-N-Out to support herself and her family.

Money is tight and with the aid she receives while attending El Camino College, Ruvalcaba said she tries to be smart with her finances. But sometimes financial aid and minimum wage earnings are not enough to pay for everything, she said.

Her paychecks go to paying for college expenses—textbooks, tuition, school supplies and transportation—and getting to class requires taking two buses to get from her home in South Los Angeles to Torrance.

Ruvalcaba is one of many EC students who work a part-time job while going to college. Whether to pay for bills or school expenses, students work jobs because they need more income.

That’s not uncommon, according to Laura Szabo-Kubitz, the associate California program director at The Institute for College Access and Success, a nonprofit public policy and research organization based in Oakland, California.

Taking on a job is a way to pay for an “affordability gap” created by the difference between a student’s cost of attendance and financial aid in the form of grants or scholarships.

Another way to pay for that affordability gap besides working a job can also be in the form of taking out federal student loans.

For the first time in five years, El Camino College will be giving students like Ruvalcaba the option of taking out federal loans to help pay for the cost of college, EC Assistant Director of Financial Aid Kristina Martinez said.

Martinez said some students on campus could benefit from borrowing money to pay for college.

“There are students where maybe getting an extra $5,000 a year can really make the difference of them being able to not have to take on work outside and be able to focus on studies,” Martinez said.

For the last five years, if an EC student wanted to take out a loan to help pay for the college expenses, they would have had to go to a private lender like a bank.

“A lot of times with those loans, they are looking at your credit score and repayment, so a lot of times students need cosigners,” Martinez said. “Their interest rates aren’t locked the same way the federal government is.”

Szabo-Kubitz said having federal student loans available brings the safest form of borrowing to students’ financial options.

“Federal loans are by far the safest form of borrowing,” Szabo-Kubitz said. “They come with certain consumer protections that private loans and other types of debt don’t have.”

That includes in many cases fixed low interest rates, income-driven repayment plans and several different types of loan forgiveness programs, she said.

“I think the upshot is that when students need to cover the gap, they have access to the safest form of borrowing which are federal loans,” Szabo-Kubitz said.

An exit from the Federal Loan Program

Under former EC President Thomas Fallo’s administration, El Camino College exited the William D. Ford Federal Direct Loan Program in 2014, closing off an avenue by which students could receive help in paying for college expenses.

The Union reached out to Fallo by phone. He declined to say anything more than the decision to exit the federal loan program was in lieu of concerns about EC’s cohort default rate (CDR) rising.

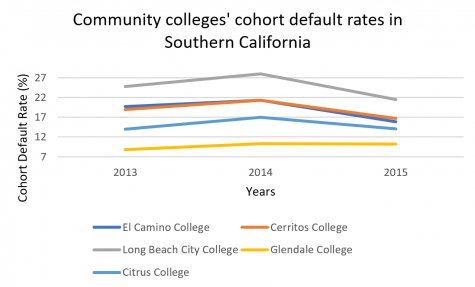

CDR is defined by the U.S. Department of Education website as the ratio of a school’s federal student loan borrowers who default on their student loan out of a school’s number of federal student loan borrowers who enter repayment in a fiscal year.

Students who default on their loans are those who haven’t made a loan payment in nine months. Defaulting on a student loan will make students face legal consequences and lose eligibility to receive federal student aid, according to the U.S. Department of Education website.

“If a student does default, it can obviously have a negative impact on their ability to purchase a home or start a business,” Szabo-Kubitz said. “There are real concerns with defaulting that can have negative effects for students.”

Furthermore, if a college’s CDR is or exceeds 30% for three consecutive fiscal years, colleges can receive consequences from the government, Assistant Director of Financial Aid at Cerritos Community College Jamie Quiroz said.

“If your default rate gets too high, the feds may intervene, the [U.S.] Department of Education may require you to do a default management plan,” Quiroz said. “If it gets really high and continues to be high, they could say you’re not allowed to give out anymore financial aid.”

The Union reviewed data from the U.S. Department of Education website and compared community college’s CDR and found other colleges in Southern California have had a higher or similar CDR to EC.

However, EC’s CDR over the fiscal years 2013, 2014 and 2015 were respectively 19.7%, 21.3% and 15.8%, according to the U.S. Department of Education Website. EC’s CDR trend over those three years were not close to the 30% sanctioning threshold.

Szabo-Kubitz said it would be ideal to not have any students default on their loans “but in terms of the larger picture, 15.8% is pretty far from the threshold of 30% or more for three years in a row.”

About 20 miles east of EC is Cerritos College, a community college with a similar demographic and total student population to EC. Cerritos College’s CDR for the 2013, 2014 and 2015 years closely resemble EC’s: 18.9%, 21.3% and 16.7% from 2013 to 2015, according to the U.S. Department of Education website.

For all of those years, the difference between Cerritos College’s CDR and EC’s CDR was never higher than 0.9%, yet EC decided dropped out of the federal loan program while almost every college in its area remained in the program. Some colleges had a higher CDR than EC and continued offering students federal loans.

Long Beach City College, a community college that has a similar demographic and student population to EC, had a CDR of 24.8%, 28% and 21.5% between the years 2013 and 2015, according to the U.S. Department of Education website, and remained in the federal loan program as well.

Although their CDR was lower than EC’s during the years 2013, 2014 and 2015, both Citrus College and Glendale College remained in the federal loan program.

EC has been the only community college in its area to not offer federal student loans over the past few years, Martinez said.

While no form of borrowing is risk-free, federal loans being made accessible to students is important because it is the safest form of borrowing, Szabo Kubitz said.

“I think that having access to federal loans is important,” Szabo-Kubitz said. “There is research that shows that frontloading financial aid—having more financial aid earlier in college—can be helpful.”

While she has not taken out loans during her time at EC, Ruvalcaba sees how students can benefit from loans, she said.

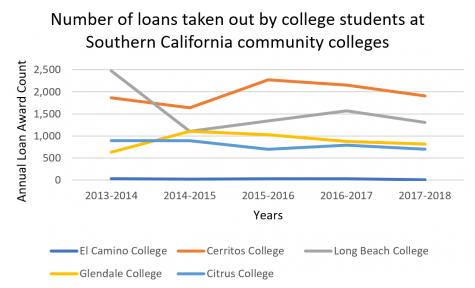

students since over the last five years. Colleges other than El Camino College have been

offering federal loans to students in the thousands. Data Source: CCCCO MIS Data Mart

Loans at California Community Colleges

The Union reviewed data for the last five years from the California Community Colleges Chancellor’s Office Management Information Systems Data Mart (CCCCO MIS Data Mart) and found that community colleges in Southern California other than EC have been giving out loans in the thousands.

Long Beach City College gave out about 1,300 loans in the 2017 to 2018 academic year totaling a little more than $3 million given out to students.

Cerritos College gave out close to 2,000 student loans totaling more than $4.5 million for the 2017 to 2018 academic year.

On the opposite side of Los Angeles, another community college, Citrus College, has a student population of less than half that of EC. Citrus College gave out more than 600 federal student loans totaling over $1.5 million in the 2017 to 2018 academic year.

Glendale College, located just north of Los Angeles, has a similar student population to EC and gave out more than 800 loans in the 2017 to 2018 academic year, totaling over $1.5 million dollars as well.

And while offering federal student loans at EC is a step in the right direction, students need to approach financial aid by looking at the whole picture of their college career, EC Director of Financial Aid Melissa Guess said.

“Loans can both assist a student and they can harm them in the future,” Guess said.

Guess said it’s important for students to be prepared and to understand their options when taking out student loans. She added that she would never tell students to borrow money if they absolutely did not need to.

“But if we can assist students to be successful by providing this additional avenue of aid while they’re in school, then by all means, absolutely, they should borrow,” Guess said.

Guess also explained that students should not have to worry about finances when attending college, they should be able to only have to focus on academics.

“Whenever we’re worried about money, it impacts our ability to be successful because you’re worrying,” Guess said. “I think it [loans] will allow students to focus on why they’re here and not how they’re going to pay for it.”

Although Southern California community colleges besides EC have been offering loans and respective students are taking them out, Quiroz recommends waiting to take out loans until later in college or transferring to a four-year university.

“I don’t encourage students at the community college level to take loans,” Quiroz said. “It would not help them to incur any debt, it’s only going to hurt them.”

Quiroz added that if students do take out loans, borrowing only the amount they need rather than the loan amount offered is a smart way to go.

Quiroz said that loans can be beneficial for students but waiting until they are needed before taking one out is a way to save as much money as possible.

“It’s only kind of a last resort when it’s between dropping out of college and actually finishing, then sometimes it is necessary,” Quiroz said. “When students are able to pay back their loans, they can see it as a positive.”

She also said that understanding financial aid options are incredibly important and that students should be taking advantage of as much grant money from the federal government as possible before considering loans.

She said financial literacy workshops at Cerritos College help students understand the different types of loans and what they require.

Waiting until it’s necessary

Although the CCCCO MIS Data Mart indicates that federal student loans are being offered to and taken out by students at colleges surrounding EC, students like Ruvalcaba do not want to take out student loans while attending community college.

Ruvalcaba said she feels dissuaded from taking out loans because her fear of having debt in the future is brought on by knowing many of her friends and relatives are mired in repayment plans years after their college graduation.

However, her situation is a little bit more difficult, she said.

“Since both of my parents are undocumented immigrants and both of my parents have medical conditions, [they] can’t work,” Ruvalcaba said. “So, regardless, that’s why if I take out a loan, I know I wouldn’t be able to pay it off.”

She said her father wakes every morning at 5 a.m. and finds work in construction while her mother babysits every day. Seeing them struggle has made getting an education more important to her, she said.

“Going to school just means becoming a successful person and helping my parents,” Ruvalcaba said. “My goal has always been like going to school, getting a degree, graduating and having like a better life. It’s like becoming someone.”

And while paying for college can get difficult, she is determined to find ways to make it work.

“I’ve struggled but now I’m here,” she said. “But I’m also proud of how far I’ve come.

Furthermore, the volume of students at surrounding colleges taking out loans can mean that students at EC are also interested in them as well, history major Bryant Manjarrez said.

“It shows a lot of schools are offering [loans] and people are actually taking advantage of it,” Manjarrez said. “It shows that people are actually interested in it.”

He also said that EC offering student loans may even attract new students who may need to take out loans during their time at a community college.

Manjarrez will be transferring to a California public four-year university in fall 2019 and did not have to take out any loans for the two years he attended EC because of the financial aid packages he received.

However, Manjarrez foresees himself taking out loans in the future after transferring and said they are sometimes essential for students to pay for college expenses.

“If [a loan] were to help someone, then obviously it should be pushed for,” Manjarrez said. “The fear of having a loan should always be outweighed by what you gain.”