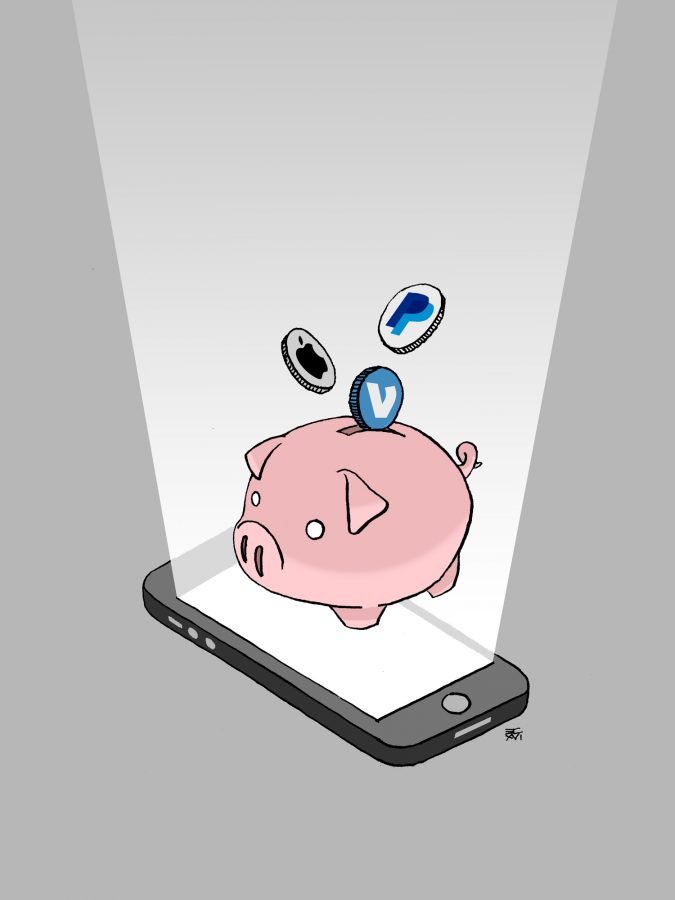

With the continuous advancement of technology nowadays, it has become much more easier and convenient to make transactions via an electronic money service rather than using actual paper currency.

The ability to have control of your bank account anywhere and at anytime you want is one of the several reasons why so many people, especially millennials who can’t put their phones down, prefer to use electronic money over having to carry around cash.

Electronic cash services have become hugely popular on a global scale, allowing you to transfer money almost instantly to anyone in the world.

These services are safe to use because they save your information so that you do not have to provide debit or credit card numbers to a person or website when making a transaction. They also provide a history of the transactions that have been made so that you and your bank can always be able to trace where your money is going.

It makes for a lighter wallet and is safer to use considering the fact that you don’t have to worry about who is watching when you pull out a hefty amount of cash from your pocket.

Paypal is an extremely easy to use electronic money transfer service and more and more businesses have taken advantage by offering it as a form of payment.

“If you made any purchase online using PayPal, it will take funds from the sources you have been given already. It does not require any bank account number, Net-banking user id and password, credit card number, expiry date, etc., and it will not disclose any of your details with any other person or websites,” according to an article on www.mnymakers.com

Services such as PayPal, Venmo and Square Cash allow users to transfer money using an email or a phone number as long as there is a credit or debit card connected.

Venmo has risen in popularity among the younger generation because it allows you to connect using your Facebook account. This allows the user to safely transfer money to someone on their list of friends who also uses the service.

“All data is sent over a 256-bit encrypted connection—the same encryption method used to protect classified government information—and transactions are protected by the Federal Deposit Insurance Corporation,” according to an article on www.slate.com

So when you are out to eat with your friends and the check comes and you find yourself staring into the bottomless black hole that is your wallet, it would be much more convenient to have a friend spot you and you could pay them back instantly rather than having to go and get cash out from an ATM.